There’s a provision that allows aliens in the U.S.[1] to choose to be treated as a U.S. resident for tax purposes even if they would not otherwise qualify as a resident. Income tax rules themselves are already really confusing — and they are even more complicated for foreigners in the U.S. — so a typographic error could really confuse a taxpayer.

I think the IRS made a typographic error, but I’m not even sure how to get in touch with them to fix this.

Motivating example

Suppose you arrive in the U.S. for the very first time on October 1, 2015 to work for the foreseeable future on a TN-1 (NAFTA Professional) visa. Because the period from 2015-10-01 to 2015-12-31 is insufficient to meet the Substantial Presence Test,[2] you would otherwise be a nonresident alien for tax year 2015. This would mean your income in the United States might be subject to taxation in the U.S. as well as in your home country. What if you wanted to be treated as a resident alien starting on October 1, 2015 — despite not satisfying the Substantial Presence Test?

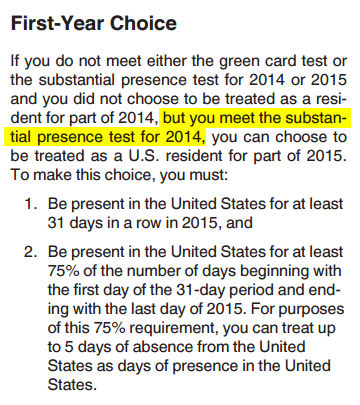

This is the First-Year Choice, and it’s documented in Publication 519 (“U.S. Tax Guide for Aliens”) by the IRS.

The error

I got a little confused when I first read the rule, because it seemed to require an impossibility:

Let me excerpt that to show why it’s so self-contradictory: “If you do not meet either the [GCT] or the [SPT] for 2014 … but you meet the [SPT] for 2014.”

Huh? Clearly they meant 2016 there. Moreover, if you met the SPT for 2014, the current tax year — 2015 — wouldn’t be your first year in the U.S.

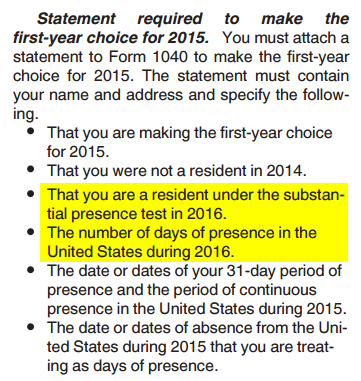

This is confirmed by the bulleted list on the following page:

Motivating example resolved

If you are going to satisfy the Substantial Presence Test in the following tax year — 2016 — you can choose to pretend to be a U.S. resident from 2015-10-01 to 2015-12-31 as well, if you meet all of the requirements in the bulleted list above.

Footnotes

| 1 | ↑ | Foreigners, not extraterrestrials. |

|---|---|---|

| 2 | ↑ | The Substantial Presence Test (SPT) requires, in its simplest form, at least 183 days of physical presence within the United States in a three-year period. |

I have the same concern. Did you try to reach out to IRS to ask about this typo? I went through there website but did not find an efficient way to contact them about this. I think it is better to ask them for a correction about this.

It looks like the error has been in Publication 519 for many years. I’d have to see if I can make contact through alternative channels.

Hi, I’m looking in to this first year choice since we arrived in the US in September 2017. I can not figure out if we can make this choice… If I read the IRS example on Juan DaSilva on the IRS page, I would imagine that is a similar situation as ours but on the other hand I can’t figure out if we needed to be present in 2016 to make this choice. I can’t seem to find the answer!

In your case, assuming that you have been continuously in the U.S. since your arrival…

The short of it is: you can elect the First-Year Choice if