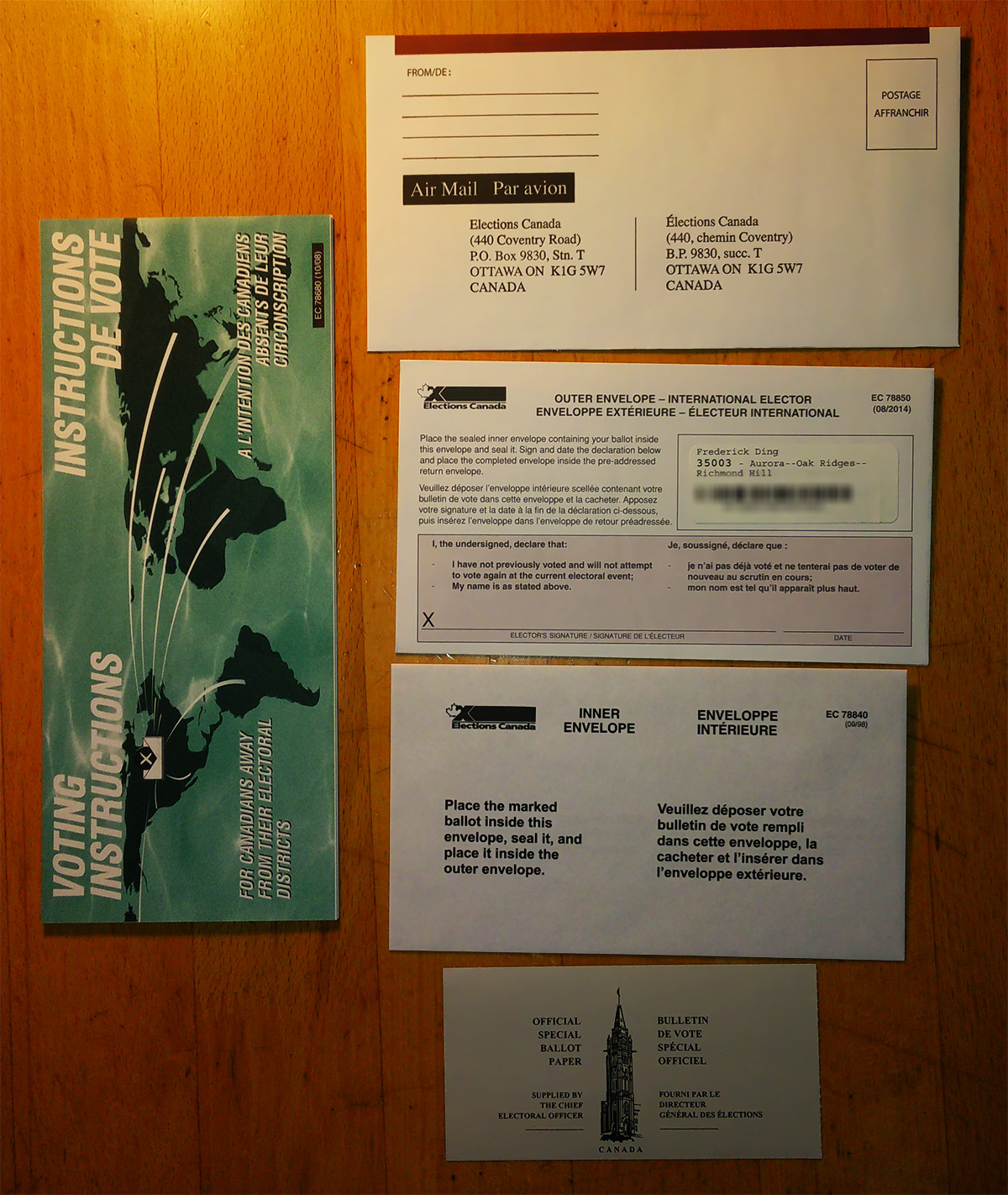

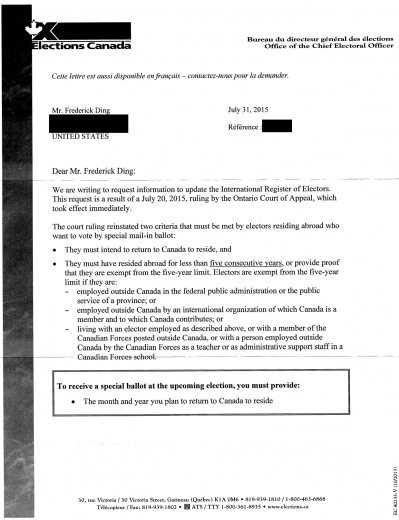

In Frank v. Canada (Attorney General), 2015 ONCA 536, the Court of Appeal for Ontario decided that Canadian expatriates could be denied the ability to vote after 5 years of residency abroad, in spite of the Charter clause guaranteeing citizens the right to vote, reversing an earlier court ruling that had vacated the temporal limit. Letting all citizens vote would be “unfair” to Canadians who live in Canada, apparently.

As a Canadian expat (US green card holder), I sincerely hope this case is overturned on appeal to the Supreme Court of Canada.

Like the respondents, who “attended university in the U.S. and remained there to pursue careers in their chosen professions”, my choice to be in the United States to advance my studies and career in the law is a matter of circumstance. Acquiring a green card did not signal the surrender of my citizenship and all its rights, responsibilities, and privileges.

It’s already annoying enough when the tax agencies of the two countries—CRA and IRS—use different definitions of residency for tax purposes… which differ from the governments’ definitions of residency for immigration purposes… which apparently differ from some U.S. states’ definitions of residency for driver’s licences…

… but now to convolute the meaning of a citizen’s right with a resident’s right?

I remain invested in the direction of the Canadian government and try to stay informed about Canadian politics. I still receive communications from multiple Canadian parties, am a supporter of two activist groups involved in IP and media law, and continue to engage in discourse with resident Canadians about the state of the nation.

As an individual with only one citizenship—Canadian—being disenfranchised at the end of five years from voting in Canadian federal elections would leave me with no democratic representation in any jurisdiction, since noncitizens in America are forbidden from participating in the U.S. electoral system even as a donor to any campaign. Even Canadian felons would have more political representation than I would have. This untenable situation would reasonably drive an expat to pursue foreign citizenship, if only to regain those rights and privileges that one would have expected Canadian citizenship to guarantee.

The Charter doesn’t define the right to vote by residency, but by citizenship. Section 3 provides:

Every citizen of Canada has the right to vote in an election of the members of the House of Commons or of a legislative assembly and to be qualified for membership therein.

The majority opinion contends that residency has been historically a factor in implementing the electoral system that enables citizens to exercise the right to vote, but the court erroneously conflates the implementation of a constitutional right with the acceptable boundaries on that right.

It embraces the vague notion of protecting the “social contract”, a principle in which individuals who make laws must also obey them, as a legitimate purpose to restrict the voting rights of expatriates. But really, expatriates remain bound by Canadian laws, particularly those affecting taxation, citizenship, and property… Laws passed in Canada, far from having “little to no practical consequences” for my expat family as the majority opinion contends, affect us financially (at least in terms of loans and taxes), affect my parents’ property and retirement assets and income, and influence our choices later down the road about whether or not to return to Canada.

… and it’s not like every resident citizen is affected by every law anyways! Bear with me for a moment; consider this perspective: the scope of a law often excludes those people who supported it. A law limiting concealed carry handguns, for instance, would probably be passed by those people who themselves have no need or desire to engage in the actions that the law prohibits. Indeed, this ruling actually enables resident citizens to violate the social contract principle supposedly being protected: a hypothetical law imposing 50% taxes on foreign income earned by nonresident citizens, for example, could be passed by representatives of resident citizens living comfortably in Vancouver and Toronto unaffected, while disenfranchised citizens abroad would be the ones affected.

This case better make its way to the Supreme Court of Canada.